Fascination About Pvm Accounting

Fascination About Pvm Accounting

Blog Article

What Does Pvm Accounting Mean?

Table of ContentsAll about Pvm AccountingPvm Accounting Things To Know Before You BuyNot known Facts About Pvm AccountingThe 10-Second Trick For Pvm AccountingAbout Pvm AccountingPvm Accounting Can Be Fun For EveryoneGetting The Pvm Accounting To Work

In terms of a company's total strategy, the CFO is accountable for assisting the business to meet monetary objectives. Some of these methods can involve the business being gotten or purchases going forward.

As a company expands, accountants can free up more personnel for various other organization tasks. This can ultimately cause boosted oversight, higher accuracy, and far better conformity. With even more sources following the trail of money, a contractor is a lot more most likely to make money accurately and promptly. As a construction company expands, it will require the help of a permanent financial personnel that's handled by a controller or a CFO to manage the firm's finances.

More About Pvm Accounting

While huge organizations might have permanent financial support teams, small-to-mid-sized businesses can work with part-time bookkeepers, accounting professionals, or financial consultants as needed. Was this post practical?

Reliable audit practices can make a considerable distinction in the success and growth of building firms. By implementing these practices, building companies can improve their monetary security, enhance procedures, and make informed decisions.

Thorough estimates and budgets are the foundation of building and construction project administration. They assist steer the project towards timely and rewarding conclusion while securing the passions of all stakeholders involved. The key inputs for project expense evaluation and spending plan are labor, products, equipment, and overhead expenditures. This is normally one of the greatest expenses in building and construction tasks.

A Biased View of Pvm Accounting

An accurate estimation of materials required for a project will assist guarantee the necessary products are acquired in a prompt manner and in the appropriate quantity. An error right here can lead to wastefulness or delays because of product scarcity. For the majority of building and construction tasks, equipment is required, whether it is purchased or leased.

Do not neglect to account for overhead expenses when approximating task expenses. Straight overhead expenses are details to a job and might include short-lived services, utilities, fence, and water materials.

One other element that plays into whether a task is effective is an exact quote of when the task will certainly be finished and the associated timeline. This estimate helps ensure that a project can be finished within the assigned time and sources. Without it, a task may run out of funds before conclusion, creating potential job standstills or desertion.

What Does Pvm Accounting Do?

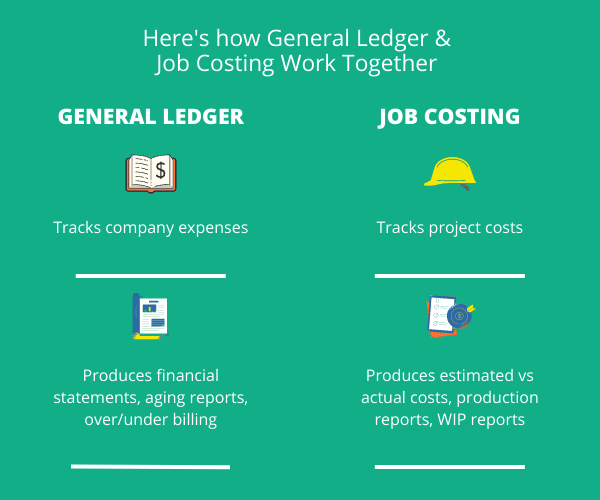

Precise task setting you back can help you do the following: Comprehend the profitability (or do not have thereof) of each task. As task costing breaks down each input right into a job, you can track productivity individually.

By identifying these i loved this items while the task is being completed, you stay clear of shocks at the end of the job and can address (and hopefully prevent) them in future jobs. A WIP routine can be finished monthly, quarterly, semi-annually, or each year, and consists of task information such as agreement worth, sets you back incurred to date, complete approximated expenses, and overall task billings.

The smart Trick of Pvm Accounting That Nobody is Discussing

Budgeting and Projecting Devices Advanced software application supplies budgeting and projecting capabilities, enabling building business to prepare future tasks a lot more properly and handle their funds proactively. Paper Administration Construction tasks entail a lot of documentation.

Boosted Vendor and Subcontractor Administration The software can track and take care of settlements to vendors and subcontractors, making certain prompt repayments and maintaining great relationships. Tax Prep Work and Filing Audit software application can assist in tax preparation and declaring, making sure that all appropriate financial tasks are precisely reported and tax obligations are filed in a timely manner.

Pvm Accounting Things To Know Before You Buy

Our client is a growing growth and building firm with head office in Denver, Colorado. With multiple energetic building jobs in Colorado, we are trying to find an Audit Assistant to join our group. We are seeking a full time Accounting Aide that will be liable for providing practical assistance to the Controller.

Get and assess everyday invoices, subcontracts, adjustment orders, acquisition orders, check demands, and/or other associated documentation for completeness and conformity with monetary plans, treatments, budget plan, and legal needs. Precise handling of accounts payable. Get in invoices, authorized attracts, order, etc. Update month-to-month analysis and prepares spending plan trend reports for building and construction projects.

Pvm Accounting Can Be Fun For Everyone

In this overview, we'll dive right into various aspects of building audit, its significance, the requirement tools utilized in this field, and its function in building tasks - https://www.quora.com/profile/Leonel-Centeno-4. From financial control and expense estimating to capital administration, check out just how bookkeeping can profit building and construction projects of all scales. Building and construction accounting refers to the specific system and processes made use of to track economic details and make tactical decisions for building and construction businesses

Report this page